In today’s fast-paced digital age, online personal loans have become an increasingly popular financial tool for individuals in the United States. These web-based credit solutions offer a blend of advantages and potential hazards that every borrower should understand before proceeding. While the appeal of borrowing money online is clear, it’s crucial to weigh both sides of the coin to make an informed decision.

The advantages of online personal loans

Convenience stands out as one of the most significant benefits of obtaining a personal loan online. Unlike traditional bank loans that require numerous visits and paperwork, digital loans can be processed entirely from the comfort of one’s home. This is particularly beneficial for those with busy schedules or limited mobility.

Speed is another major advantage. Online lenders often provide quicker approval times compared to brick-and-mortar banks. In many cases, funds can be deposited into a borrower’s account within the same day or a few days, making them ideal for emergencies or unforeseen expenses.

Moreover, online lending platforms typically offer competitive interest rates due to lower operating expenses. Borrowers can compare numerous offers from different lenders, ensuring they get the best possible terms for their financial situation.

Flexible loan options

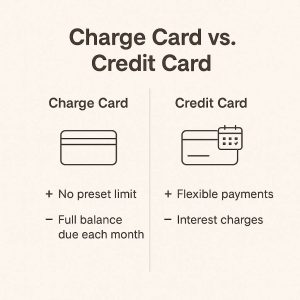

Another notable benefit is the flexibility these loans offer. Online lenders often provide a wide range of loan products tailored to differing needs and credit profiles. Whether you’re looking for a small amount to cover an unexpected bill or a larger sum for a significant purchase, there’s likely an online loan that fits your requirements.

This flexibility extends to repayment terms. Many online lenders offer various repayment schedules that can be customized to suit a borrower’s financial situation, making it easier to manage monthly payments without stretching your budget too thin. Accessibility is also enhanced with online loans. Those with less-than-perfect credit histories may find it easier to qualify for a loan online than through traditional channels.

Privacy and discretion

Borrowing online also offers a degree of privacy and discretion that might not be available with face-to-face banking. The entire process can be completed without having to discuss your financial situation in person, which is appealing to many.

Furthermore, online applications typically provide enhanced security measures, ensuring that your personal and financial information remains confidential. The use of encryption and secure servers helps protect sensitive data from potential breaches. Overall, the anonymity and safety offered by online loan platforms make them an attractive option for many borrowers.

The potential risks of online personal loans

Despite the myriad benefits, online personal loans are not without their risks. One of the primary concerns is the potential for predatory lending practices. Some online lenders may charge exorbitant interest rates or include hidden fees, which can lead to a cycle of debt that’s difficult to escape from.

It’s essential to thoroughly research any online lender and read all terms and conditions carefully before committing to a loan. Look for lenders with transparent pricing and good customer reviews to avoid falling victim to unscrupulous practices.

Another risk to consider is the impact on your credit score. Applying for multiple loans in a short period can negatively affect your credit rating. It’s advisable to limit the number of loan applications and ensure you’re financially capable of meeting repayment obligations.

Choosing credible lenders

To mitigate these risks, it’s vital to choose credible and reputable lenders. Start by verifying that the lender is registered and in good standing with regulatory authorities. Check for reviews and ratings from other borrowers to gauge their reliability. Using comparison websites can also be an effective strategy.

These platforms aggregate loan offers from various lenders, allowing you to compare interest rates, fees, and other terms in one place. They often include ratings and reviews, giving you an additional layer of information to base your decision on. Additionally, consider seeking advice from financial advisors or trusted sources to ensure you’re making the best choice for your financial health.

Potential for scams

Another significant risk associated with online loans is the potential for scams. The internet can be a breeding ground for fraudulent activities, and financial services are no exception. Be wary of unsolicited offers, particularly those that seem too good to be true. Scammers may use high-pressure tactics to push you into making quick decisions.

Legitimate lenders will never rush you into signing a contract or ask for upfront fees. Always take the time to verify the legitimacy of the lender and avoid sharing personal information with unverified sources. By staying vigilant and conducting thorough research, you can safeguard yourself against potential scams.