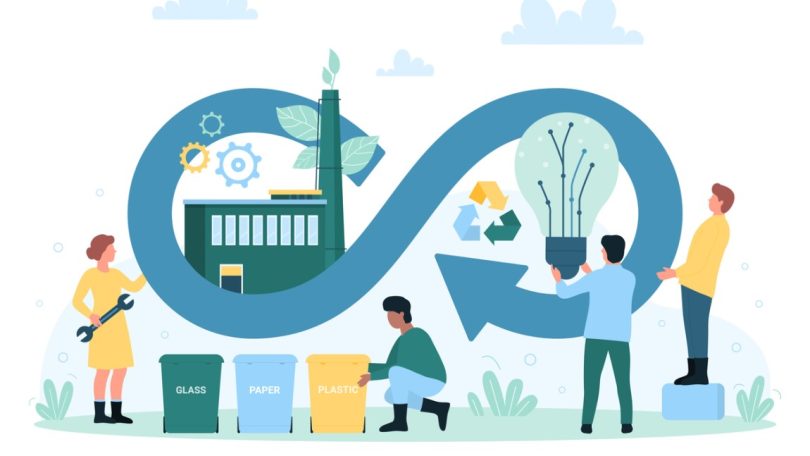

Investing in local and community businesses is more than a monetary contribution; it’s a driving force for fostering sustainable economic growth and social impact. This trend supports the principles of a circular economy, where resources are reused, shared, and regenerated to maximize their utility.

By channeling funds into local enterprises, investors can witness the blossoming of communities and the environment, paving the way for a vibrant, resilient future. With the rise of this economic model, more people are recognizing the value of maintaining wealth within their communities, thus promoting job creation and reducing the carbon footprint associated with large-scale industries.

The shift towards community-centric investments

This new wave of community-centric investments advocates for keeping capital within one’s own neighborhood, thus backing local talent and innovation. By prioritizing smaller, community-based initiatives, investors not only gain financial returns but also contribute to the social fabric of their localities.

Locally-geared investment fosters a more interconnected society, where businesses thrive on personal relationships and direct community support. This approach stands in stark contrast to the impersonal nature of global corporations and signifies a significant move towards a conscious and sustainable economic footprint.

Reaping benefits while driving social change

Community investments don’t just yield monetary benefits; they generate positive societal outcomes. These investments empower small businesses to flourish, creating local jobs and fostering economic inclusivity. Projects often address community-specific needs, from improving local infrastructure to initiating sustainable agricultural practices.

As part of this growing trend, investors find themselves supporting sustainable development goals and reinforcing the economic ecosystem’s health and vitality. The sense of pride in witnessing local transformation is unparalleled and strengthens individual and corporate ties to the communities they serve and inhabit.

Encouraging circular economic practices

A critical component of local investments is the promotion of circular economic practices. This innovative model prioritizes efficient resource use, minimizing waste and fostering collaboration. When funds are directed towards businesses that adhere to these principles, a ripple effect occurs throughout the local economy.

Investment in such enterprises can lead to robust supply chains where materials are continuously sourced and utilized with minimal waste. This approach not only enhances sustainability but also offers a competitive edge by reducing production costs in the long run.

Practical steps to join the movement

Getting involved in local investments might seem daunting, but it starts with simple actions. Begin by researching and identifying businesses and projects within your community that align with circular economic values. Attend local business networking events to understand community needs and potential partnerships.

Consider joining platforms that connect investors with local enterprises, facilitating opportunities for impact investing. For those seeking to further ease the process, look into financial products like community development banks or credit unions that provide not just financial services but also insights on local investment opportunities.

Concluding thoughts on investing in your community

The growing interest in investing in local and community businesses aligns seamlessly with the principles of a circular economy. Such practices not only benefit the environment but also stimulate economic vitality and build stronger, sustainable communities.

Incorporating these investment strategies into one’s financial portfolio represents more than a potential for personal gain; it symbolizes a movement towards mutual prosperity and collective well-being. As individuals reassess their roles in the global economy, local investments offer a tangible way to make impactful change both now and for future generations.